Sales Tax Missouri Calculator

Missouri Sales Tax Calculator

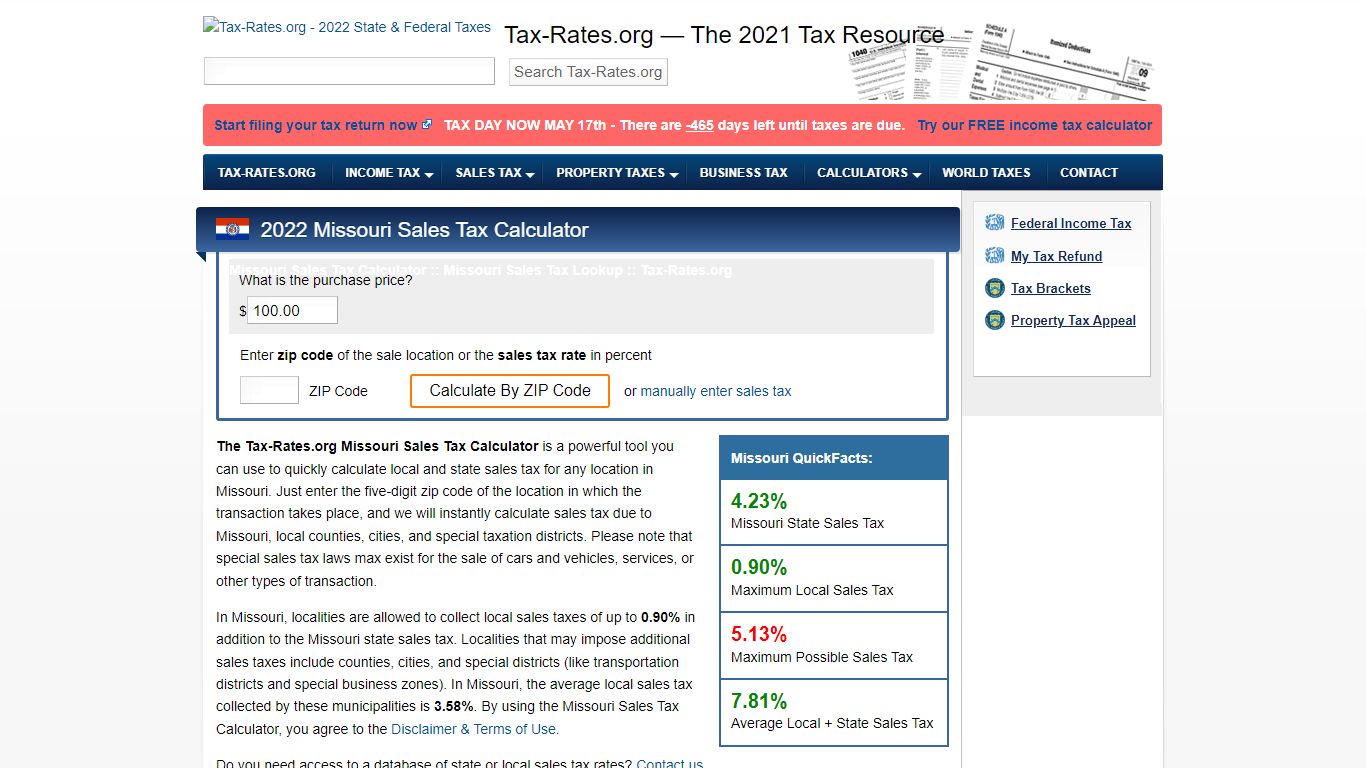

Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Missouri, local counties, cities, and special taxation districts. Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction.

https://www.tax-rates.org/missouri/sales-tax-calculator

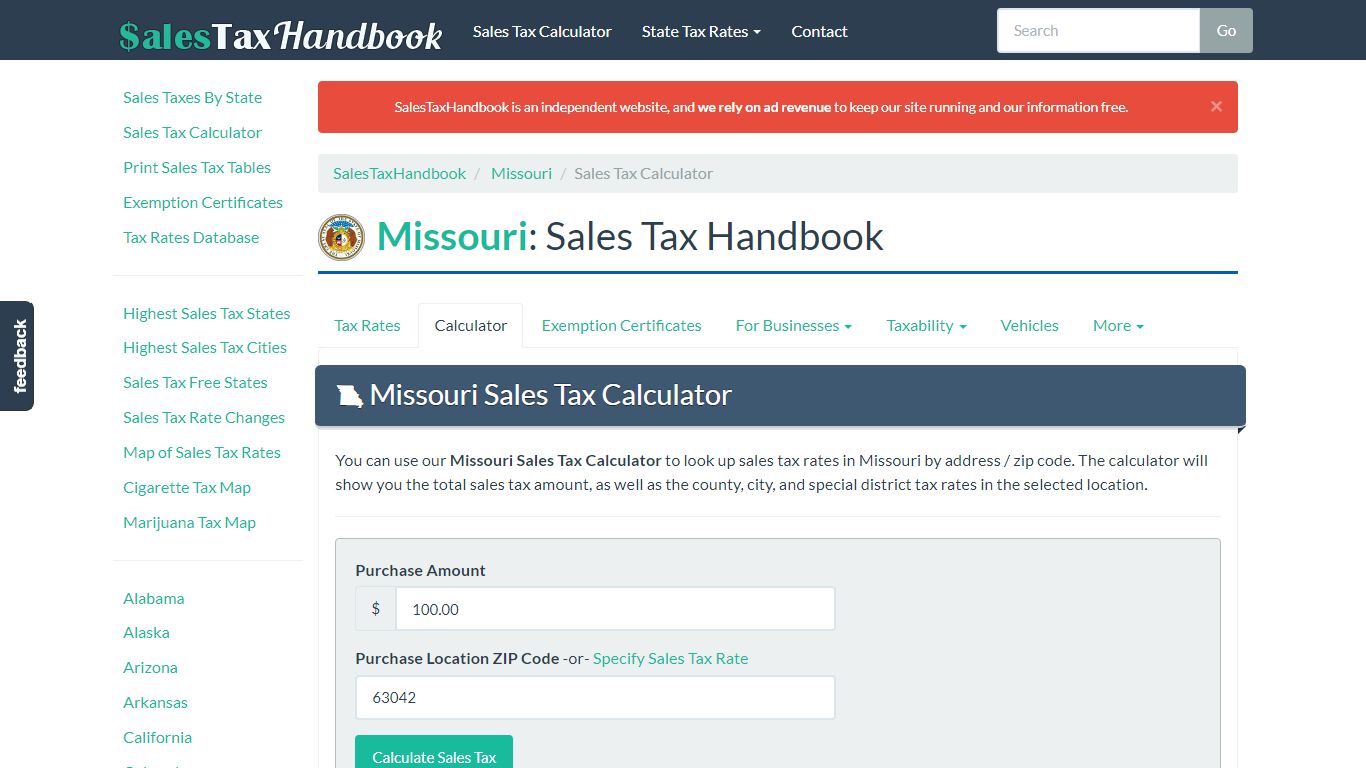

Missouri Sales Tax Calculator - SalesTaxHandbook

You can use our Missouri Sales Tax Calculator to look up sales tax rates in Missouri by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Purchase Location ZIP Code -or- Specify Sales Tax Rate

https://www.salestaxhandbook.com/missouri/calculator

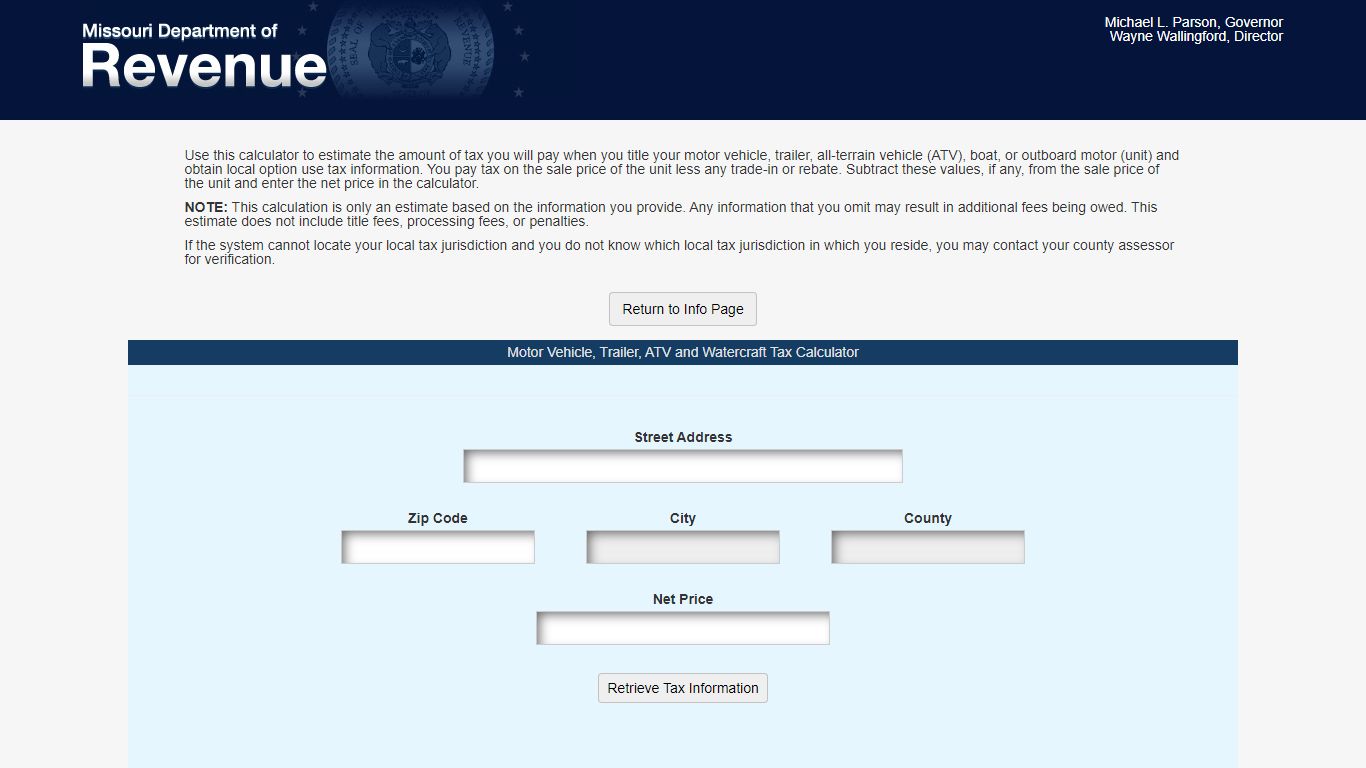

Tax Calculator - Missouri

You pay tax on the sale price of the unit less any trade-in or rebate. Subtract these values, if any, from the sale price of the unit and enter the net price in the calculator. NOTE: This calculation is only an estimate based on the information you provide. Any information that you omit may result in additional fees being owed.

https://sa.dor.mo.gov/mv/stc/

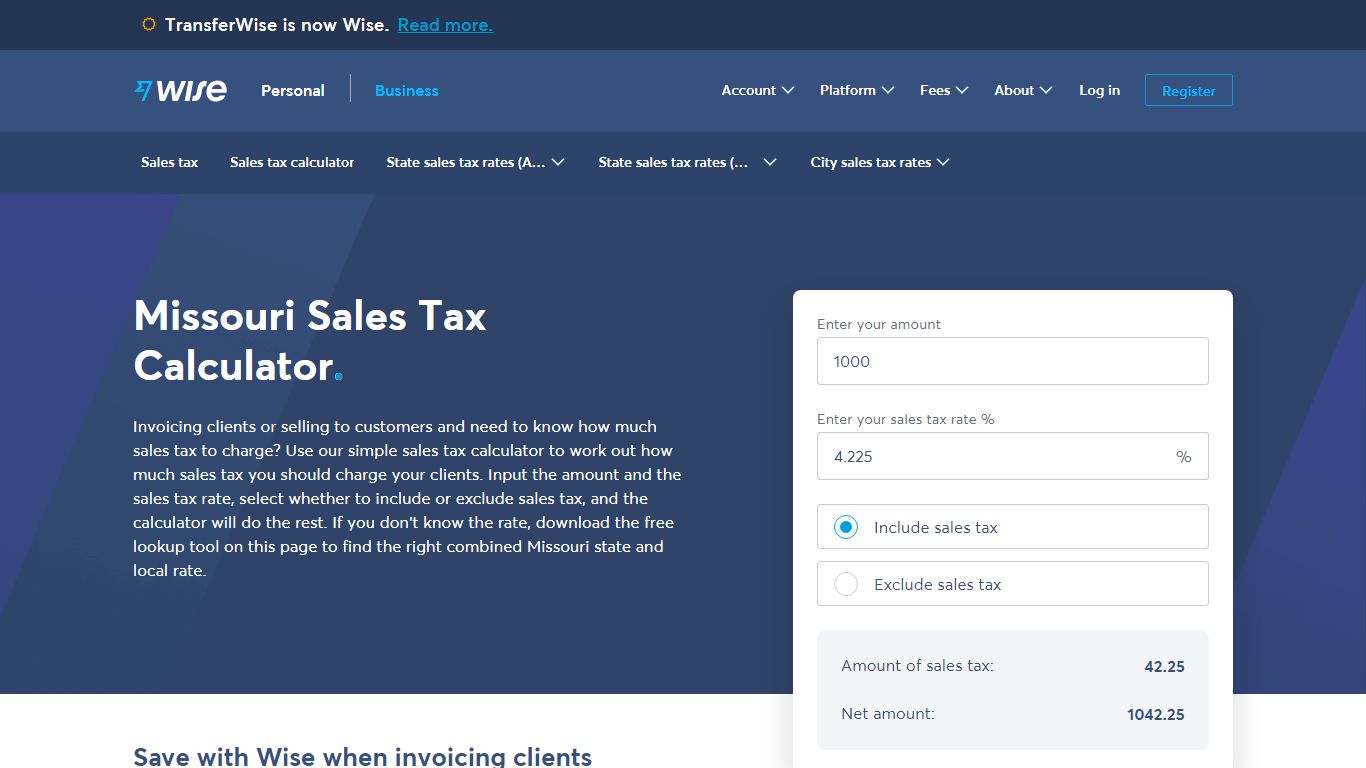

Missouri Sales Tax | Calculator and Local Rates | 2021 - Wise

The base state sales tax rate in Missouri is 4.23%. Local tax rates in Missouri range from 0% to 5.875%, making the sales tax range in Missouri 4.225% to 10.1%. Find your Missouri combined state and local tax rate. Missouri sales tax rates vary depending on which county and city you’re in, which can make finding the right sales tax rate a headache.

https://wise.com/us/business/sales-tax/missouri

Tax Calculators - Missouri

Use our handy calculators linked below to assist you in determining your income tax, withholding, or penalties for failure to file or pay taxes. Additions to Tax and Interest Calculator Income Tax Calculator Sales/Use Tax Bond Calculator Withholding Calculator

https://dor.mo.gov/calculators/

Motor Vehicle, Trailer, ATV and Watercraft Tax Calculator - Missouri

Home » Motor Vehicle » Sales Tax Calculator The Department collects taxes when an applicant applies for title on a motor vehicle, trailer, all-terrain vehicle, boat, or outboard motor (unit), regardless of the purchase date. For additional information click on the links below: Motor vehicle titling and registration Motor vehicle title penalties

https://dor.mo.gov/motor-vehicle/sales-tax-calculator.html

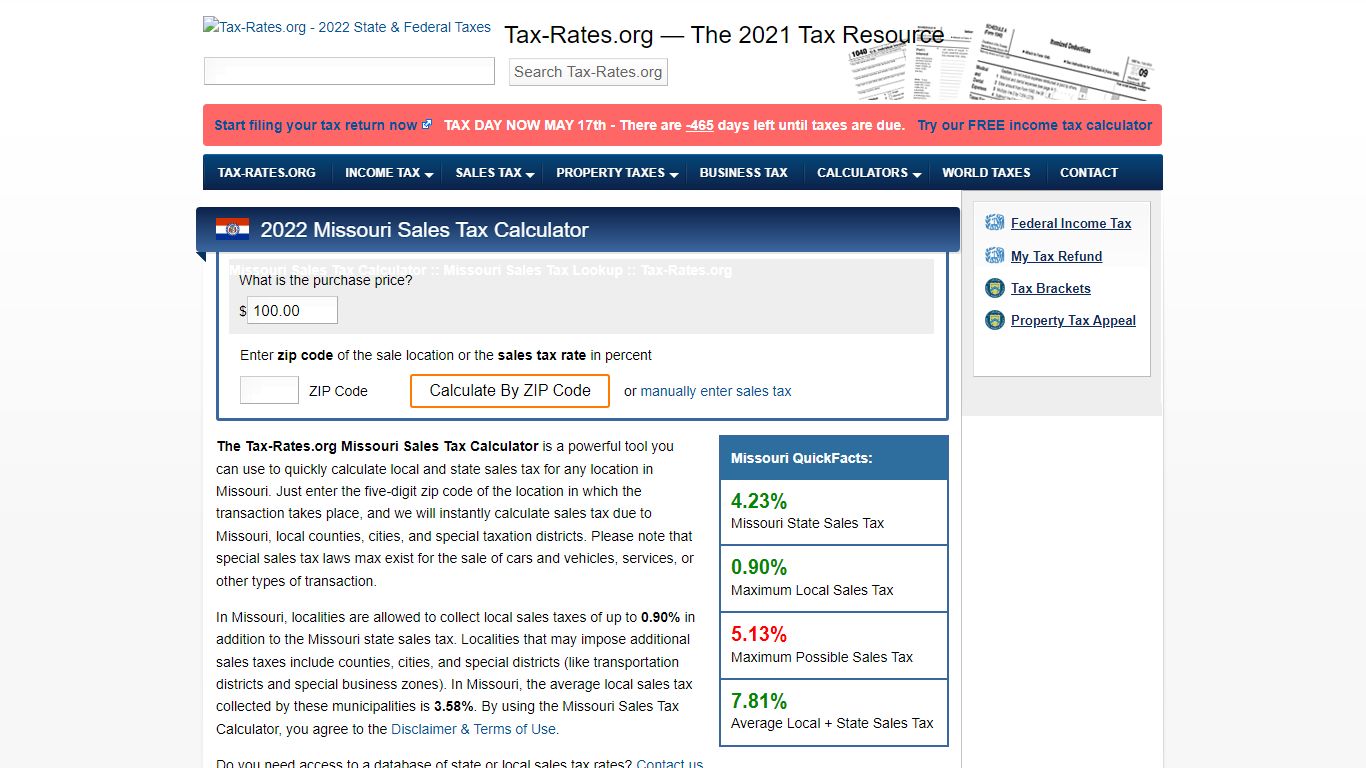

Missouri Sales Tax Calculator - Tax-Rates.org

Just enter the five-digit zip code of the location in which the transaction takes place, and we will instantly calculate sales tax due to Missouri, local counties, cities, and special taxation districts. Please note that special sales tax laws max exist for the sale of cars and vehicles, services, or other types of transaction.

https://www.tax-rates.org/missouri/sales-tax-calculator?action=preload

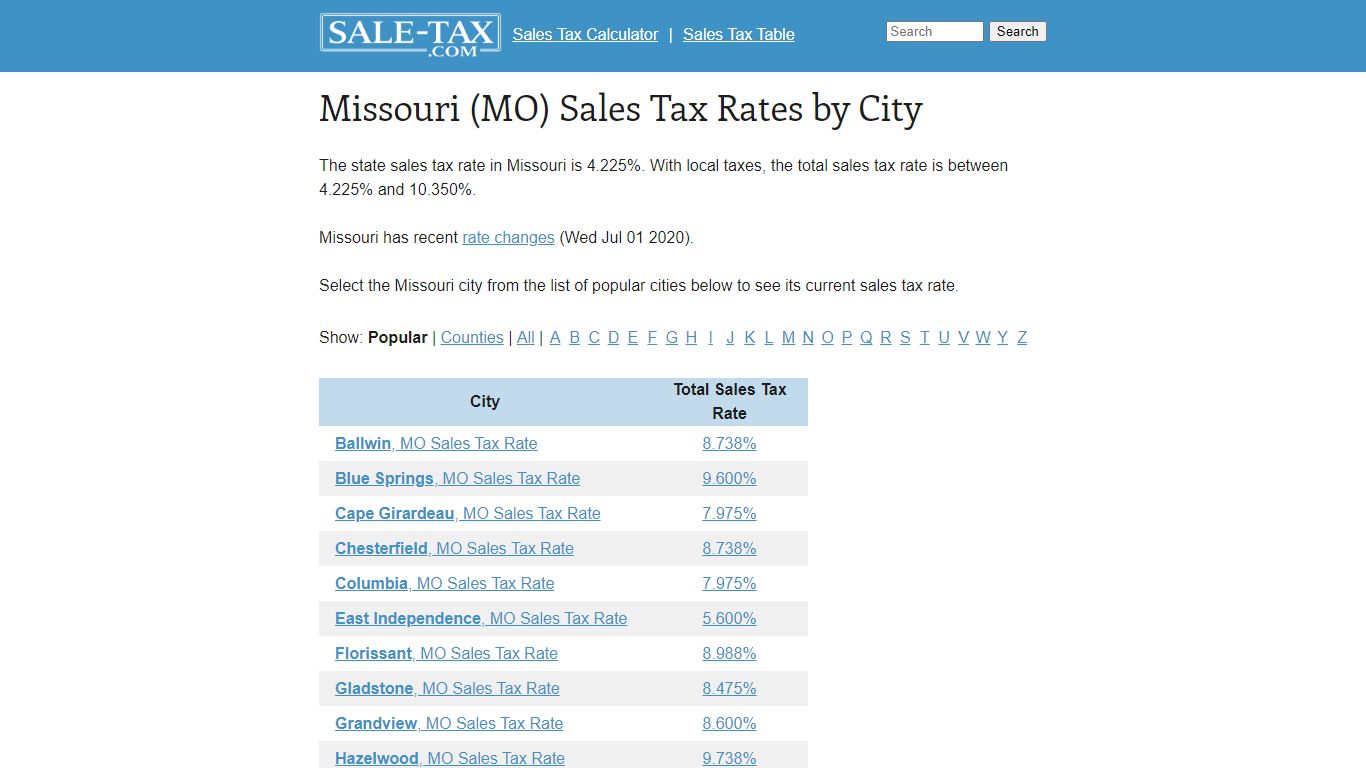

Missouri (MO) Sales Tax Rates by City - Sale-tax.com

Missouri (MO) Sales Tax Rates by City Missouri (MO) Sales Tax Rates by City The state sales tax rate in Missouri is 4.225%. With local taxes, the total sales tax rate is between 4.225% and 10.350%. Missouri has recent rate changes (Wed Jul 01 2020). Select the Missouri city from the list of popular cities below to see its current sales tax rate.

https://www.sale-tax.com/Missouri

Sales/Use Tax - Missouri

The 4.225 percent state sales and use tax is distributed into four funds to finance portions of state government – General Revenue (3.0 percent), Conservation (0.125 percent), Education (1.0 percent), and Parks/Soils (0.10 percent). Cities and counties may impose a local sales and use tax.

https://dor.mo.gov/taxation/business/tax-types/sales-use/

Missouri Car Sales Tax Calculator - Car and Driver

The Tax-Rates.org Missouri Sales Tax Calculator is a great tool to use to determine how much your local and state sales taxes will be when buying a car in Missouri. To use this calculator, simply...

https://www.caranddriver.com/research/a32813123/missouri-car-sales-tax-calculator/